As the global agricultural sector accelerates its shift toward smart farming, industry leaders John Deere, Case IH, and Claas are locked in an intense battle to dominate the high-end harvester market with groundbreaking technological innovations, according to industry insiders and the latest sector reports.

The competition comes as new data highlights the critical role of intelligent harvesters in boosting agricultural productivity. A recent report from China’s Ministry of Agriculture and Rural Affairs, released on Dec. 4, emphasized that autonomous farm machinery technologies—including those adopted by major global players—have increased operational efficiency by over 20% while reducing labor costs by more than 50% in large-scale farming

scenarios.

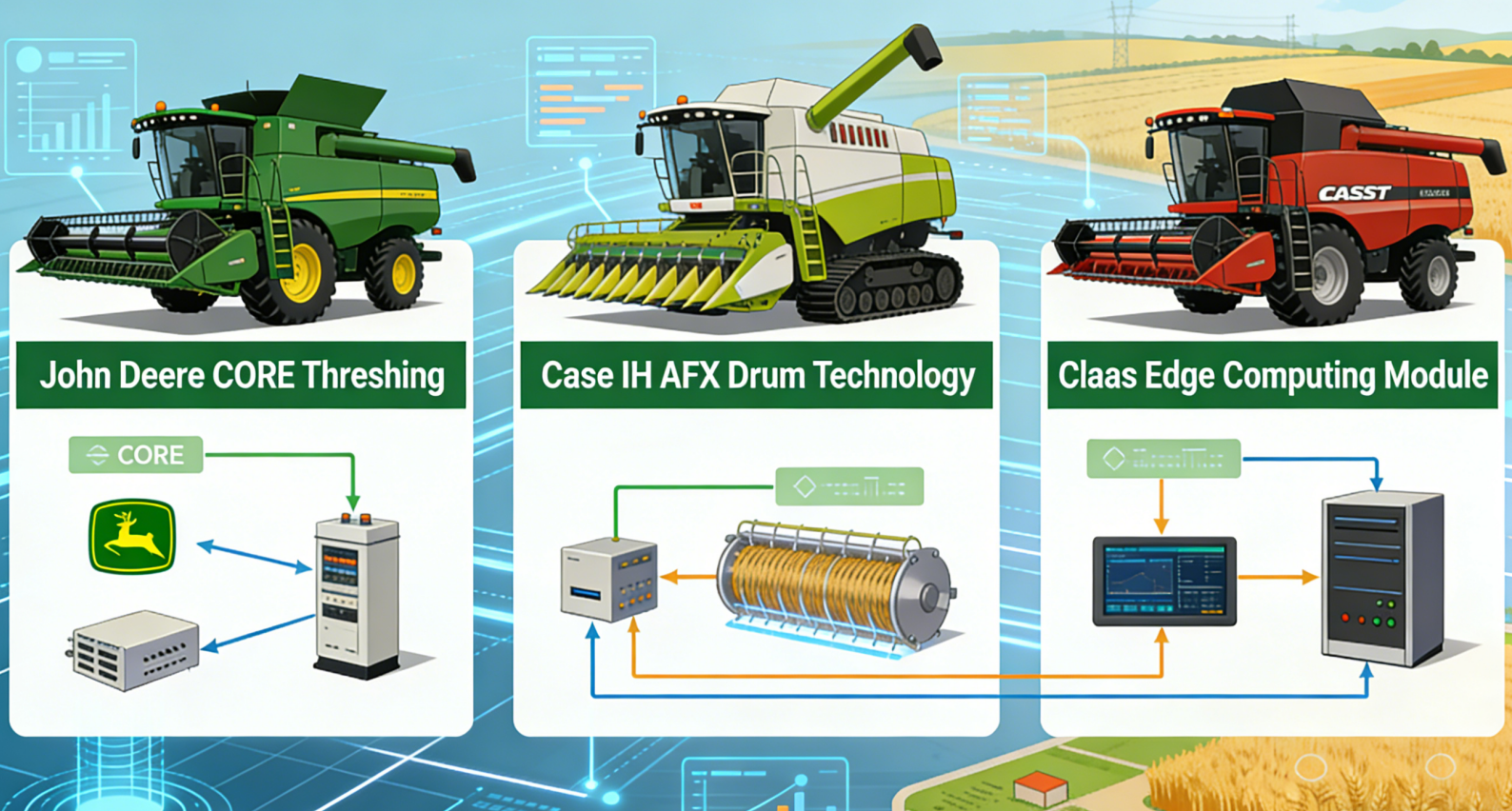

John Deere, a U.S. agricultural equipment behemoth, continues to lead with its X9 1000 series combine harvester, which has become a benchmark in the ultra-large-scale harvesting segment. Equipped with the revolutionary CORE™ threshing and separation system, the 630-horsepower machine boasts a grain tank capacity of 14.8 cubic meters and can be paired with cutting platforms up to 50 feet wide. Industry analysts note that the X9 1000′s ability to achieve over 99% separation efficiency while minimizing grain damage has solidified its position as a top choice for large commercial farms across North America and Europe.

Case IH, a key brand under CNH Industrial, is challenging competitors with its newly upgraded AF10 Axial-Flow® series, particularly the AF10 1020 model. Touted as the “horsepower king” at recent industry events, this harvester delivers an impressive 770 horsepower and supports Draper PT cutting platforms up to 45 feet. Its enhanced AFX™ axial-flow drum threshing system is specifically designed to handle high-yield, high-humidity crops, making it a reliable workhorse for extreme harvesting conditions in regions like the U.S. Corn Belt and Eastern Europe.

Germany’s Claas, a long-standing innovator in the harvest machinery sector, remains a strong contender with its advanced Lexion series. While specific details about its 2025 upgrades are still emerging, industry sources indicate that Claas is focusing on integrating AI-driven crop monitoring systems and edge computing technology into its latest models. These enhancements aim to enable real-time adjustment of harvesting parameters based on crop倒伏 (lodging) and maturity levels, reducing grain loss rates to below 0.3%.

The race for dominance in the smart harvester market is being fueled by the rapid growth of the global agricultural equipment sector. Market research firm QYResearch projects that the global harvester market will expand from $29.96 billion in 2024 to $38.45 billion by 2031, with a compound annual growth rate of 3.7%. The Asia-Pacific region, particularly China, is expected to be a key driver of this growth, with智能化 (intelligent) harvesters accounting for over 45% of new installations in 2025.

“The integration of precision navigation, cloud-based diagnostics, and autonomous operation has transformed harvesters from mere farming tools into mobile data centers,” said Dr. Emily Carter, an agricultural technology expert at the International Institute of Agricultural Engineering. “Manufacturers that can balance power, efficiency, and smart features will capture the largest market share in the coming years.”

As the Northern Hemisphere’s winter harvesting season winds down, all three giants are gearing up for the 2026 planting and harvesting cycles, with expectations of more breakthroughs in electric propulsion and hydrogen fuel cell technology to meet increasingly stringent environmental regulations worldwide.

Post time: 12-09-2025