Chicago, U.S. – December 31, 2025 – As 2025 draws to a close, the global agricultural machinery sector presents a tale of two divergences. Leading manufacturers John Deere and Case IH (a brand of CNH Industrial) are grappling with severe headwinds in their home U.S. market, driven by lingering impacts of tariff policies that have crippled farmer purchasing power. Meanwhile, Germany’s Claas has maintained relative stability, bucking the downward trend seen among major competitors, according to year-end industry updates released over the past week.

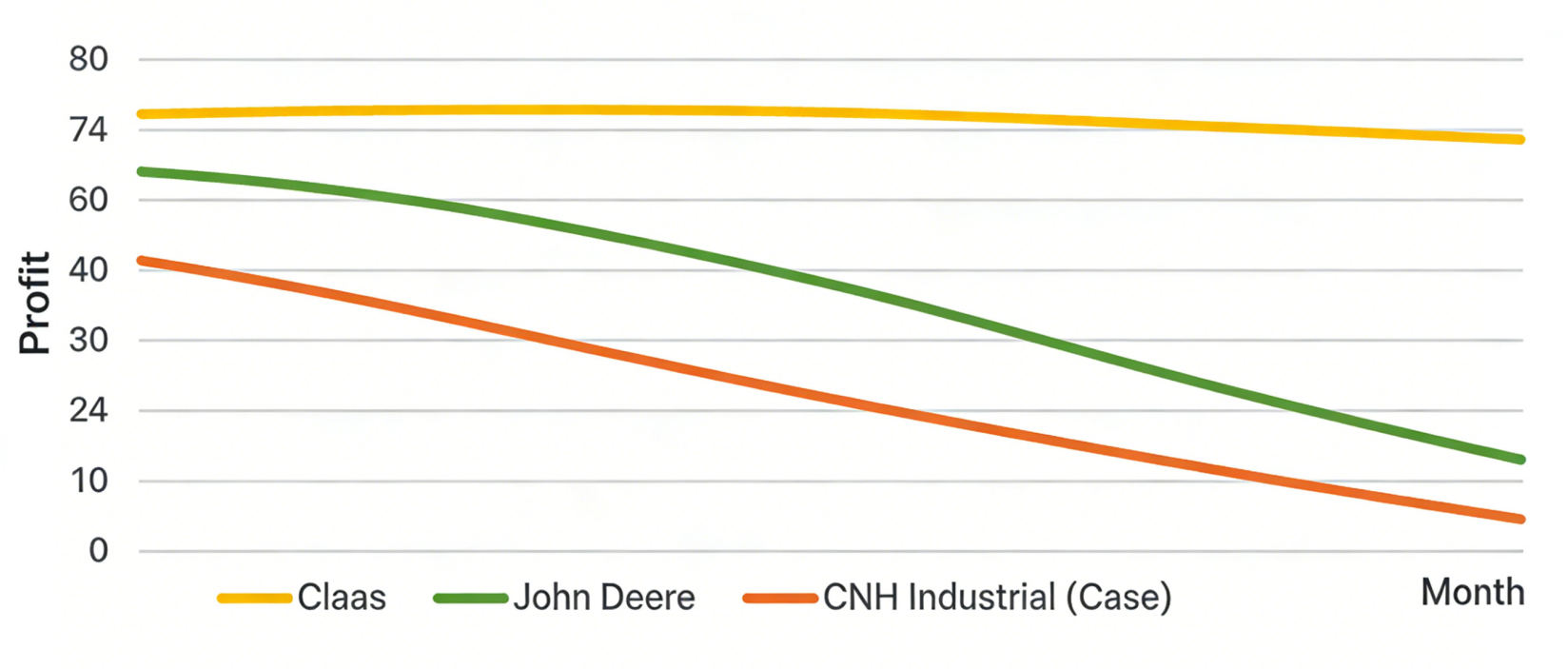

The tariff-induced slump in the U.S. agricultural sector has reached a critical point as 2025 concludes. John Deere, the world’s largest agricultural machinery manufacturer, confirmed in a year-end briefing on December 28 that its full-year 2025 net profit plummeted by 29% to $5 billion, with large agricultural equipment sales – including combine harvesters and high-horsepower tractors – bearing the brunt of the decline <superscript id=”3″>1. Cory Reed, president of John Deere’s Agriculture and Turf Division, reiterated that the downturn is largely confined to the U.S. market, where farmers, squeezed by plummeting crop prices and rising production costs, have delayed replacing aging equipment <superscript id=”4″>3. “Our Waterloo, Iowa, tractor plant produced only half the number of units this year compared to two years ago,” Reed stated, adding that the company has implemented multiple rounds of layoffs in 2025 and plans further cuts in 2026 <superscript id=”5″>2.

The pain is not isolated to John Deere. Case IH’s parent company, CNH Industrial, reported a 7% decline in industrial product sales (including agricultural machinery) for the third quarter of 2025, with a 12% drop year-to-date <superscript id=”6″>4. While Case IH has not released full-year 2025 figures, industry analysts anticipate similar challenges in the U.S. market, where tariff-driven cost increases for steel and components have further squeezed profit margins. The Trump administration’s tariffs on Canadian and Mexican imports have exacerbated the issue, as many key parts for U.S.-manufactured agricultural machinery are sourced from these neighboring countries <superscript id=”7″>2.

In stark contrast, family-owned German manufacturer Claas has emerged as a bright spot. The company announced on December 22 that it maintained stable sales of €4.9 billion in its 2025 fiscal year (ending ahead of the calendar year), narrowly down from €5 billion in 2024 <superscript id=”8″>4. Unlike John Deere and Case IH, Claas’ focus on harvesting equipment and its stronger presence in European and South American markets – which have remained largely unaffected by U.S. tariff turmoil – have insulated it from the worst of the downturn. The company has also continued investing in new product ranges to strengthen its tractor offerings, a strategic move aimed at capturing more market share beyond its traditional harvesting equipment stronghold.

The U.S. agricultural crisis shows no immediate signs of abating. Data released by the Federal Reserve Bank of Chicago earlier this month revealed that loan repayment rates in the U.S. Midwest have fallen for eight consecutive quarters, with nearly half of agricultural lenders predicting more farm foreclosures and asset liquidations this winter <superscript id=”9″>3. The Trump administration’s $12 billion farmer aid package, announced in early December, has been widely criticized as insufficient to offset months of trade disruptions and depressed crop prices <superscript id=”10″>3. U.S. soybean prices have plummeted by approximately 40% from their mid-2022 peak, while corn prices have dropped nearly 50%, further straining farmer finances <superscript id=”11″>2.

Looking ahead to 2026, John Deere and Case IH’s parent company CNH Industrial are cautiously optimistic about a potential market recovery, viewing 2025 as the low point of the sales cycle <superscript id=”12″>4. Both plan to reduce production to de-stock supply lines and double down on technological investments to maintain competitiveness. Claas, meanwhile, aims to build on its stable performance by expanding its global footprint, particularly in high-growth markets.

Industry analysts warn that the U.S. tariff policy’s ripple effects could persist into 2026. “The divergence between U.S.-focused manufacturers and those with a more balanced global portfolio, like Claas, highlights the risks of trade-driven market volatility,” said David Morrison, senior agricultural industry analyst at Global Markets Insight. “Until there is clarity on U.S. trade policy and a sustained recovery in crop prices, U.S. farmers will likely continue to delay major equipment purchases.”

Post time: 12-30-2025